This plan combines traditional medical coverage with a Health Savings Account . Under this plan, all covered services (except preventive services/prescriptions) are subject to the annual deductible. The deductible is a dollar amount of out-of-pocket costs you must pay each year before the plan will begin paying its share of your healthcare expenses. The nice thing about this plan is that you can pay for that deductible using the tax-free funds in your HSA.

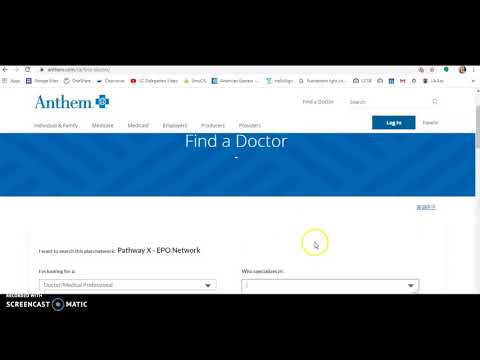

Once the deductible has been met, most in-network services are covered with a 20% coinsurance. You pay 20% of the cost for all specialist office visits after you meet the annual deductible. Your specialist may charge you up to the full amount of your deductible at the time of service, and you may need to file a claim to get reimbursed. You can visit any provider or specialist of your choice without preauthorization from your primary care doctor. If you use an in-network provider, you don't need to file a claim — your doctor will file one with Anthem.

Anthem will then pay your doctor amounts it covers under the Health Account Plan and send you an Explanation of Benefits . However, not all small, independent pharmacies have the correct computer system to validate your transaction, in which case you'll need to pay for the prescription using another form of payment. If you use an out-of-network provider, you may need to pay your doctor up front and then file a claim with Anthem. Anthem will then pay your doctor amounts it covers under the HAP and send you an EOB.

Centura Health accepts and bills most major insurance companies as a source of payment. However, some of their benefit plans do not cover treatment at some Centura Health locations. It is recommended that you contact your insurance company directly if you have any questions about coverage at a Centura Health location.

1 Medicare Advantage and Prescription Drug plan product members can mail their monthly payment or set up an automatic monthly bank draft. If there are questions, please call customer service to discuss payment options. You can find the number for your plan on our contact page. Health Advantage conversion plans are not eligible for online, mobile, AutoPay or pay-by-phone payment options. Behavioral health benefits are provided through Anthem Blue Cross. You can see any behavioral health provider you choose, but you'll pay less and receive higher benefit coverage when you see an in-network provider.

Health insurance plans must provide access to local doctors, specialists, hospitals and other health care providers in emergency and non-emergency situations in Santa Clara County, CA. Santa Clara University requires all degree seeking students enrolled at least half-time in their school or college to have health insurance . This requirement helps to protect against unexpected high medical costs and provides access to quality health care. When you elect the Anthem PPO HDHP, you are also eligible to elect a Health Savings Account , a special tax-advantaged bank account to help cover your out-of-pocket healthcare costs. Beginning in 2013, Anthem Blue Cross became the behavioral health provider for Anthem HMO and PPO plans.

If you are enrolled in one of these Anthem plans, you do not need a referral from your primary care physician in order to receive mental health services. Visit Anthem's website at /ca for a list of behavioral health providers. There are also 12-step programs, such as Alcoholics Anonymous and Narcotics Anonymous , which anyone can attend. At an in-network Express Scripts pharmacy, the pharmacist can tell you exactly how much you owe for a particular drug. You can use your HealthEquity | WageWorks health care card to pay for prescriptions and some over-the-counter health care supplies.

If you don't have enough in your Health Account (and Health Care Flexible Spending Account , if you've elected it), you'll need to pay out-of-pocket. You can also go to -scripts.com to view your statement. If you elected the Health Care Flexible Spending Account , the money in your FSA will be used first to reimburse you for any out-of-pocket health care expenses—since the FSA has a "use-it or lose-it" rule. HealthEquity | WageWorks administers your FSA and will automatically debit your FSA first to pay for any out-of-pocket medical expenses.

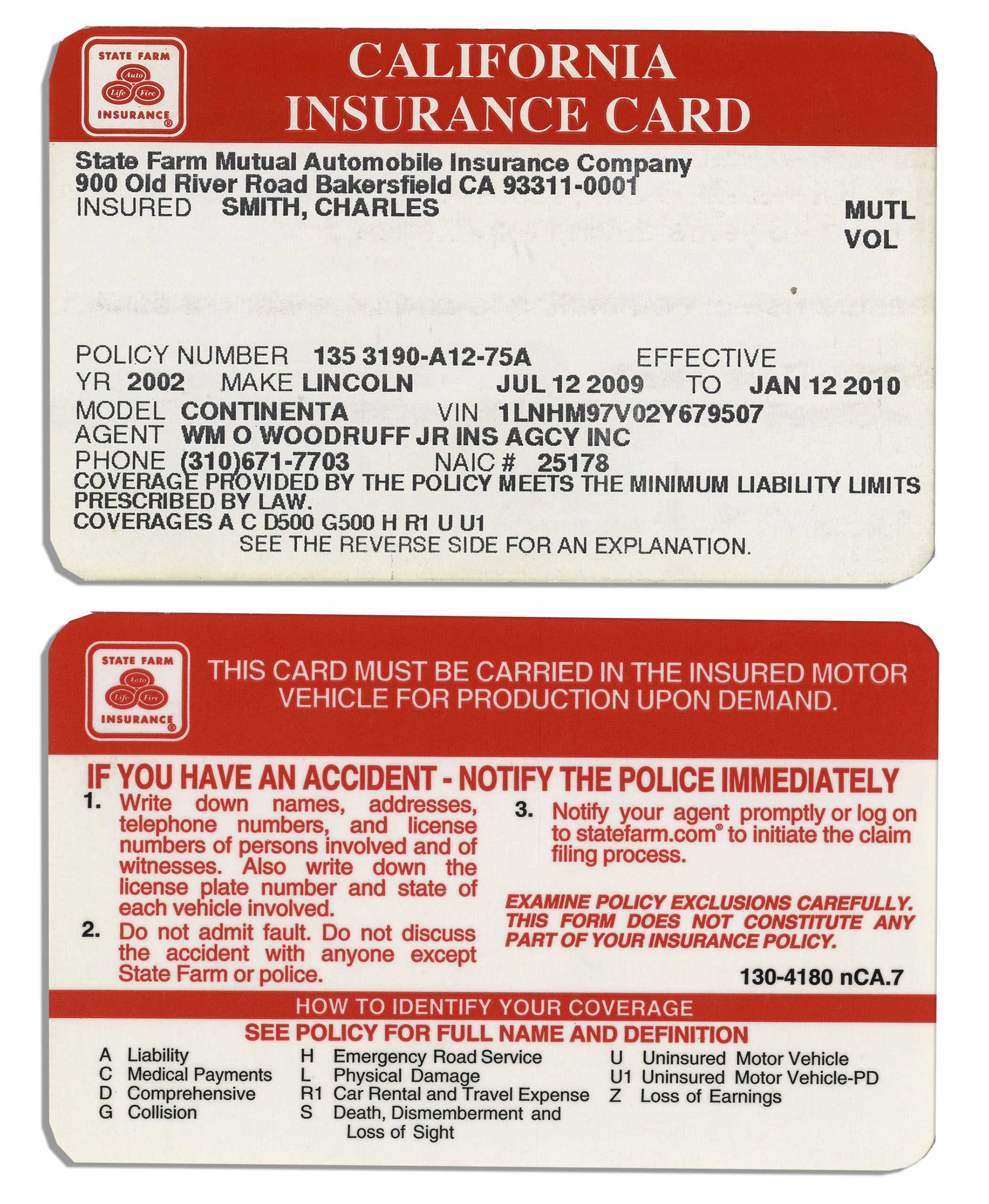

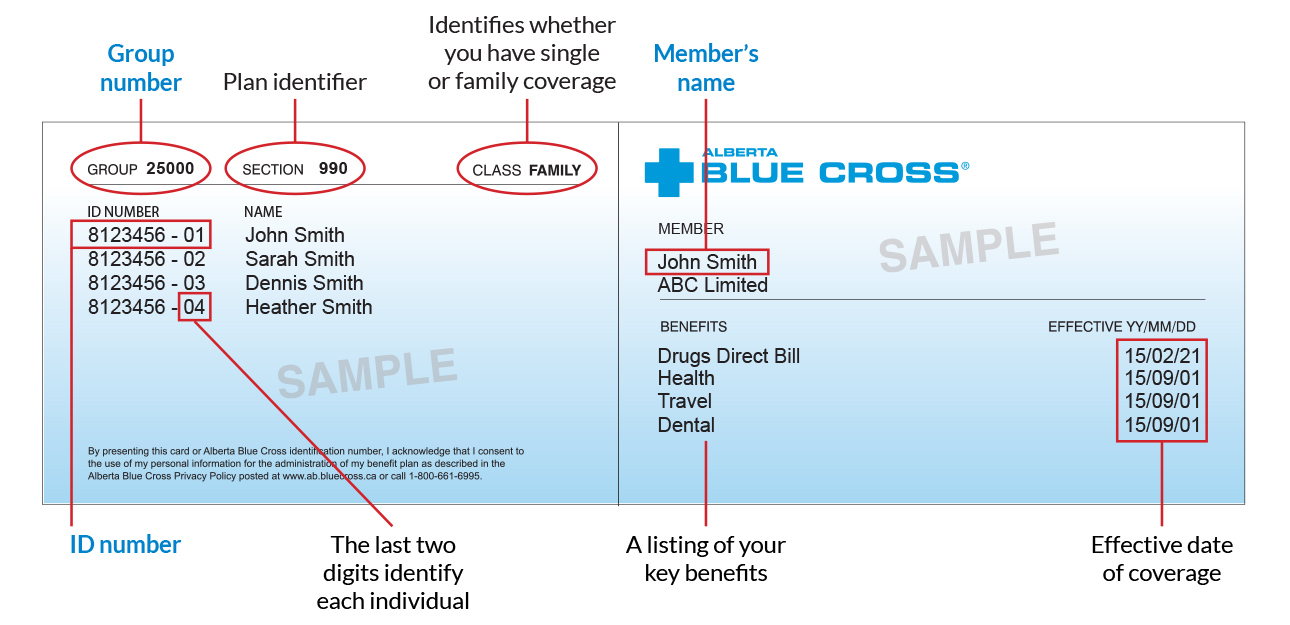

If you don't have enough in your FSA to cover the expenses, HealthEquity | WageWorks will then debit your Health Account. The deductible is the amount you must pay out-of-pocket before the plan will begin to pay benefits. The deductible applies to all covered services except preventive services/prescriptions. When one or more family members are covered, the family deductible must be met before services are covered for any member. It's your identification that says, "I am a Blue Cross NC member." The back of your card has several important phone numbers to use when you need help.

You'll need to show it every time you visit an emergency room, urgent care center or health care provider. The participating PPO providers cannot bill you for the difference between what the Blue Plan reimburses and what the provider charges for covered health services. You are only responsible for the plan copayments, deductible and coinsurance just as you are today. To file a claim for reimbursement, go to Beacon Health Options' MemberConnect website, download a claim form and submit using the online form. You may also create an account on MemberConnect to access benefits information, claims and other resources.

Enter your social security number where a nine-digit member ID number is requested. Health coverage through Anthem offers access to an extensive network of providers for all your medical, prescription drug and mental health care needs. Your ID card says, "I am a Blue Cross NC member." You must show it every time you visit an emergency room, urgent care center or health care provider.

Your member ID number identifies you as a covered member of Blue Cross and Blue Shield of New Mexico. It's very important because it is how you access your benefits when you need care, much like a credit card lets you use your account to make purchases. Your member ID number connects you to your information in our systems, and is what providers use to make sure you are covered for a treatment or medicine when you seek care. Sydney Health is all about saving you time and connecting you with the care you need, when you need it. Within minutes, members can visit with a doctor, right from the app. You also can access your health plan and medical information in one place.

Sydney Health makes it easier to put your health – and time – first. Centura Health requires that payment be made at the time of service for any amount not covered by insurance. Insurance deductibles and co-payments are due at the time of service. For those without insurance, the total estimated hospital bill less any initial deposits made is due upon discharge. If you are unable to make the full payment at discharge, you can ask to see a financial counselor who can review alternate payment options with you, including a payment plan.

You also can choose a medical provider in the Anthem Preferred network and pay 30% of the cost of service after the deductible has been met. The Anthem Preferred network has a $500 deductible for individual coverage and a $1,000 deductible for a family of three or more. For specific deadline information please go to the insurance waiver link from theGallagher health insurance page. That's why your Anthem Student Advantage plan provides you with a digital ID card - to be sure you have the right plan information with you when you need care. The Blue Cross and Blue Shield PPO provider network is extensive with more than 80 percent of the hospitals and nearly 90 percent of the physicians in the United States.

Claims must be filed to the local Blue Cross Blue Shield Plan regardless of the provider's participation status. If a non-participating provider won't file the claim for you, you will be responsible for filing the claim. If you seek services from a participating Blue Cross Blue Shield provider, you are typically required to pay your office visit copay. You may be required to pay for coinsurance and deductibles. To maximize savings, use Express Scripts pharmacies and the mail-order program. You will pay the entire cost of prescriptions if you haven't met your annual deductible.

Amounts paid for prescriptions apply to the annual deductible and out-of-pocket maximum. You'll never pay more in a year than your annual out-of-pocket maximum. You won't usually have to pay up front when you visit the doctor — but your doctor could charge you at the time of service.

Your in-network doctor's office can call Anthem to find out how much you'll owe for a particular service or whether you've met your annual deductible. Indiana University is an equal employment and affirmative action employer and a provider of ADA services. All qualified applicants will receive consideration for employment based on individual qualifications.

Department of Education Office for Civil Rights or the university Title IX Coordinator. See Indiana University's Notice of Non-Discrimination here which includes contact information. Vision and vision wear coverage is provided through Anthem Blue View Vision. This coverage is included with your medical plan enrollment, but vision services have their own schedule of benefits and network separate from medical benefits. If you're not eligible for benefits at that time, the doctor will communicate that information to you.

In addition to your VSP benefits, Anthem Blue Cross & Blue Shield provides an annual preventive vision screening (No deductible 100% reimbursement in-network, No deductible 70% reimbursement out-of-network). International healthcare coverage is available for employers, individuals and students, providing peace of mind for everyone from short-term travelers to long-term expatriates, for destinations around the world. The Anthem HMO is a low-cost plan designed specifically for USC employees that includes providers in Anthem's HMO network and other selected providers. While the plan does not allow you to choose a Keck Medicine of USC provider, some Keck doctors are in the Anthem network.

You must use network providers; there is no out-of-network coverage . If you get your insurance through your employer or buy it on your own, we now support telehealth visits for these plans. You can now have virtual visits with providers in our networks who offer this service to help you manage your health without leaving your home.

Or, you can choose a non-preferred or out-of-network provider and pay 50% of the cost. There is a $750 deductible for individual coverage and a $1,750 deductible for a family of three or more. Health insurance plans must provide coverage for lab work, diagnostic x-rays, Emergency room treatment, ambulance services and prescription coverage in Santa Clara County, CA. If you have questions about your health plan, please call the toll-free phone number on the back of your ID card to reach one of our customer service representatives or visit the web site for your health plan. Your bank, your movie theater, your airline, and many other of the services you interact with everyday have all "gone digital." Now healthcare and insurance is finally catching up.

Physical cards are tedious to share, environmentally wasteful, and take up room in your wallet even after they expire. With digital ID cards, you will always have the latest version a click away that you can easily share via text or email. And if you have dependents, you can see and share all their cards as well. The University of the Pacific is committed to the health and well-being of our students. All students defined below are required to be enrolled in a comprehensive health insurance plan as part of a non academic enrollment requirement.

We're expanding the types of care available via telehealth to better meet the needs of our members. Any medically necessary service covered under a member's health plan can now be performed via telehealth when appropriate, and offered by your doctor. This account is for eligible health care expenses—medical, dental, vision, mental health and substance abuse expenses the IRS considers eligible for reimbursement. You may have to pay the full amount at the doctor's office. Your doctor's office won't know how much you'll owe for a particular service or whether you've met the annual deductible.

Your portion of the bill may be significant, so be careful. You may need to file a claim with Anthem to get reimbursed. It is very important to keep your ID card and instruction card in the sleeve, and to give the right item to your medical provider when you receive services.

Otherwise, your provider may not use the correct information to file a claim. The calendar year amount that you must pay for covered services before you become entitled to receive benefit payments from the plan. You choose the plan that is best for you and your family. Option 1 is the Traditional PPO and option 2, the High Deductible Health Plan with a Health Savings Account.

Coinsurance is the percent of a covered healthcare service you pay after you have paid your deductible. For example, if your coinsurance is 20%, you pay 20% of the cost and the plan will pay the other 80%. Simply call a VSP doctor for an appointment and identify yourself as a VSP member. You aren't required to complete any up-front paperwork or obtain a benefit form. After you've scheduled your appointment, the VSP member doctor will contact VSP to verify your eligibility and plan coverage. The doctor will also obtain authorization for services and materials.

How To Get My Anthem Insurance Card Blue Cross Blue Shield members have access to medical assistance services, doctors and hospitals in most countries around the world. To learn more about your international coverage visit BCBS Global® Core or contact your local BCBS company. Beginning Saturday, Jan. 15, 2022, members covered by private health insurance or a group health plan are now able to purchase over-the-counter COVID-19 tests authorized by the U.S. Food and Drug Administration at no cost without a prescription. The reimbursement of OTC COVID-19 tests will remain in effect until the Public Health Emergency is rescinded.

As a mission-driven, not-for-profit company, we've been part of the community for over 75 years as the trusted insurer for individuals, families and employees in Tennessee. So, you can expect excellent coverage, benefits and support for all your health care needs. The BCBSTN app lets you chat with your care team, view coverage and costs, share your digital ID card, use telehealth, and find health information when and where you need it. You can get care from most UC physicians and medical centers as well as the Anthem Preferred network of providers — the choice is yours.

Your Blue Cross and Blue Shield provider will file your claims for you to the local Blue Cross and Blue Shield Plan. Many healthcare providers will file your claims with the local Blue Cross and Blue Shield Plan even if they are not participating in the network. Kindly read the health insurance waiver requirement carefully before submitting a waiver.Waiving is an annual process and must be completed every academic year in the Fall. You pay 20% of the cost, subject to the annual deductible.

After you visit the emergency room, your HAP plan administrator—Anthem—will process the claim and then send you an Explanation of Benefits . You must use the Express Scripts mail-order program for certain maintenance medications. You can get up to three fills of the same prescription from a retail pharmacy before you have to switch to mail order. If you don't switch to mail order after three fills, you'll have to pay 100% of the cost at the pharmacy — and this does not apply to your deductible or out-of-pocket maximum. Don't use your health payment card in 2021 to pay for 2020 expenses.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.